[ad_1]

The Dow Jones Industrial shares (DIA) have barely budged this yr even with so many shares cratering within the inventory carnage of 2022. Search for the mighty Dow to ultimately fall quick as 2023 begins.

shutterstock.com – StockNews

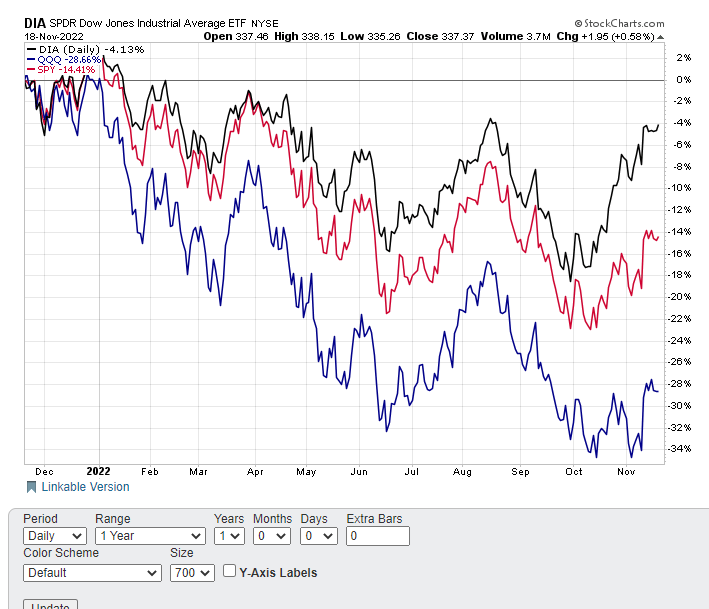

Shares have definitely bounced strongly off their current lows. NASDAQ 100 (QQQ) is now up simply over 12% from the October lows. S&P 500 (SPY) added on nearly 15% in the identical time-frame. The Dow Jones Industrials (DIA) has been the star performer, gaining almost 18% up to now two months.

Decrease rates of interest and never so horrible earnings have definitely supplied some gas for the current red-hot rally. Now that earnings season is winding down and charges are discovering a flooring, search for shares to have hassle gaining floor from right here. That is very true for the Dow 30 shares which have gotten too far forward of themselves on a comparative and precise foundation. Plus, the Dow is about to enter a seasonally bearish interval as 2023 begins. Merchants and buyers trying to quick shares could also be clever to think about doing it with DIA for these three causes simply talked about.

Comparatives

The Dow Jones Industrials (DIA) have undoubtedly been the most effective performing of the three main indices to this point in 2022. DIA is down just below 4% year-to-date whereas the S&P 500 (SPY) has misplaced over 14% and the NASDAQ 100 (QQQ) dropped almost 29% this yr. Issue within the increased dividend yield of the DIA versus SPY or QQQ and that general efficiency hole widens somewhat extra.

Usually these three indices have a tendency to maneuver in unison – or be way more extremely correlated to make use of a fancier time period. Search for each the SPY and QQQ to be relative out-performers, and the DIA the weakest of the three, in ‘23 to shut this efficiency hole again to a extra conventional relationship.

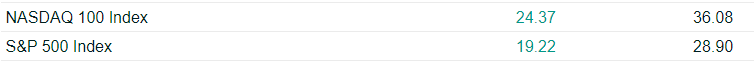

The Dow Jones has gotten considerably cheaper from a P/E valuation perspective. The present P/E stands at just below 21 at this time versus simply over 22 a yr in the past, or a drop of roughly 5%.

Evaluate that relative drop to comparable metrics on each the S&P 500 and NASDAQ 100. Each indices have seen their present valuations fall by properly over 30% on a P/E foundation. The truth is, SPY is now buying and selling at a considerably decrease P/E a number of than DIA. 12 months in the past SPY was buying and selling at nearly a 7 level premium to DIA.

Technicals

DIA is as soon as once more hit overbought readings on the chart which have corresponded with tops up to now. Shares are hovering round 70 on a 9-day RSI foundation. Bollinger P.c B breached 100 however has since softened. MACD received to an excessive however is poised to go adverse and generate a promote sign. DIA is buying and selling at an enormous premium to the 20-day transferring common and has stalled out at $340 overhead resistance as soon as once more. A pullback in the direction of the $328 space to check the 20-day transferring common appears the probably course.

Seasonality

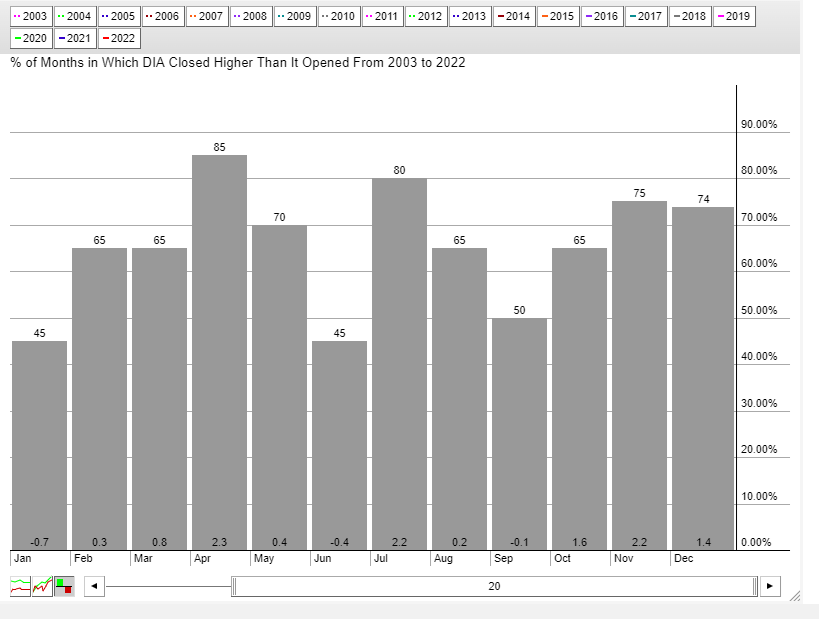

The calendar suggests the Dow will begin to slowdown because the New 12 months approaches. January has been the worst performing month over the previous 20 years with good points lower than half of the time and a mean lack of -0.70%. November, conversely, has been probably the greatest months whereas December checks in at simply above common.

Inventory merchants trying to place for a weak begin to 2023 could need to contemplate shorting DIA close to the tip of 2022.

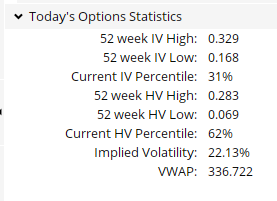

Possibility merchants might elect to placed on a bearish calendar unfold commerce by shopping for January places and hedging by promoting December places to place for an eventual pullback in January however maybe additional consolidation in December. That is very true provided that implied volatility (IV) has fallen to comparatively low-cost ranges at simply 31%, particularly versus historic volatility of twice that at 62%.

POWR Choices

What To Do Subsequent?

For those who’re in search of the most effective choices trades for at this time’s market, you must try our newest presentation Methods to Commerce Choices with the POWR Rankings. Right here we present you the best way to constantly discover the highest choices trades, whereas minimizing danger.

If that appeals to you, and also you need to study extra about this highly effective new choices technique, then click on under to get entry to this well timed funding presentation now:

Methods to Commerce Choices with the POWR Rankings

All of the Greatest!

Tim Biggam

Editor, POWR Choices Publication

shares closed at $396.03 on Friday, up $1.79 (+0.45%). 12 months-to-date, has declined -15.65%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Creator: Tim Biggam

Tim spent 13 years as Chief Choices Strategist at Man Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Market Maker for First Choices in Chicago. He makes common appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Community “Morning Commerce Dwell”. His overriding ardour is to make the complicated world of choices extra comprehensible and subsequently extra helpful to the on a regular basis dealer.

Tim is the editor of the POWR Choices publication. Be taught extra about Tim’s background, together with hyperlinks to his most up-to-date articles.

The submit 3 Massive Causes Why The Dow Jones Industrial Common Is Priming For A Pullback appeared first on StockNews.com

[ad_2]