[ad_1]

Lots has occurred since my inventory market (SPY) commentary final week! We nailed the rate of interest hike — 50 bps, as everybody anticipated — and I used to be proper that the dot plot and post-meeting commentary would spoil the social gathering. This has definitely been a market the place any unhealthy information can ship the market reeling… and that is precisely what we’re seeing now. Maintain studying for a full replace on what is going on on….

shutterstock.com – StockNews

(Please get pleasure from this up to date model of my weekly commentary printed December 19th, 2022 from the POWR Progress e-newsletter).

Regardless of all of Fed Chair Powell’s messages that there is “extra work to be achieved” to battle inflation…

Regardless of all the warnings from economists and CEOs {that a} recession is probably going in our future…

Regardless of the mass layoffs and inverting yield curves…

Everybody JUST realized subsequent yr goes to be painful. You’ll be able to see the second folks snapped out of the rose-colored haze they have been dwelling in.

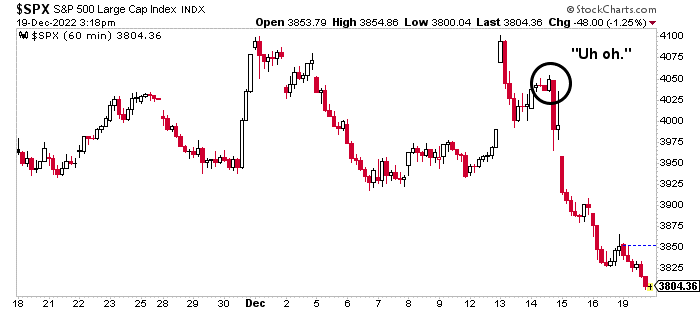

Since that is an hourly chart, you possibly can actually see how the market reacted as merchants digested the information.

Together with Monday, the S&P 500 (SPY) has offered off 5% within the 4 days since Wednesday’s price hike. Seems like Powell awoke the bears.

And sure, the Federal Reserve’s newest actuality verify — extra on this shortly — is partly accountable for the drop, however we had different forces at work as nicely.

However I’m getting forward of myself. Let’s return to Wednesday, the place all this hassle began…

First, the dot plot.

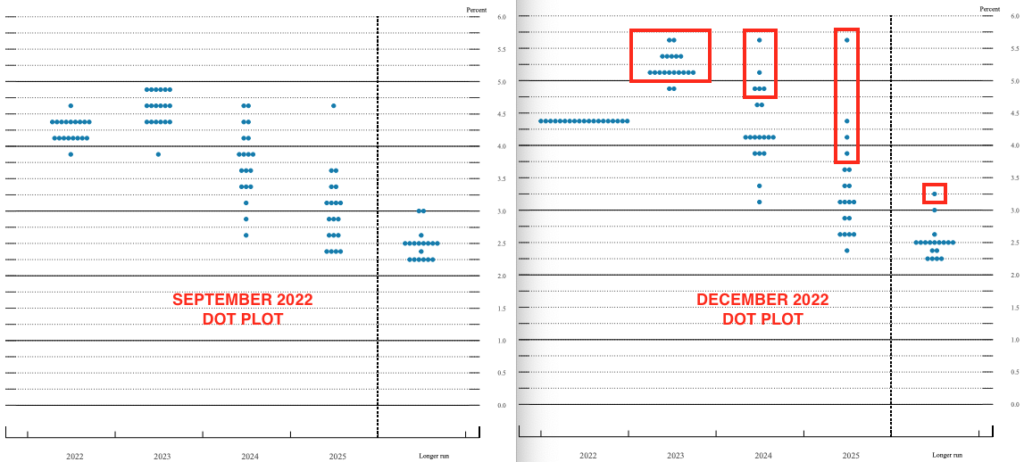

The Fed’s “dot plot” is mainly a visible software that reveals the place every of the Fed officers imagine rates of interest might be within the quick, mid, and long run. Right here’s the September dot plot (left) subsequent to the one from the December 14 assembly (proper).

The dots make it plain as day: Quite a few Fed officers now imagine we’re going to have to lift charges even greater… and hold them excessive for longer.

When the Fed final launched these projections in September, they confirmed forecasts that the fed funds price would peak between 4.75% and 5.0% someday in 2023 earlier than slowly coming again down the next years.

Now, we’ve notably extra hawkish projections for charges of 5.1% to five.4% in 2023 (with some Fed officers forecasting charges as excessive as 5.5% to five.75%)…staying above 4% all through 2024…after which perhaps coming additional down in 2025.

(Additionally, I’d like to know who that one tremendous hawk is, projecting rates of interest of 5.5% to five.75% THROUGH 2025. Daring.)

Powell’s feedback put phrases to the message painted by the visible — there’s extra work to do. Just a few selection quotes from his post-meeting press convention…

“I’d say it’s our judgment right now that we’re not in a sufficiently restrictive coverage stance but, which is why we are saying that we’d anticipate that ongoing hikes might be applicable.”

“Historic expertise cautions strongly towards prematurely loosening coverage. I wouldn’t see us contemplating price cuts till the committee is assured that inflation is transferring all the way down to 2% in a sustained approach.”

In different phrases, the Fed’s holding its foot on the fuel, and it’s not letting up till the job is completed.

The market ended the day about 0.6% decrease.

That is a strong drop, however I anticipated an even bigger response to the elevated hawkishness and reminder that the mission was removed from completed. Nonetheless, at this level, I am used to the market dismissing these bearish headwinds.

And whereas the Federal Reserve’s actuality verify was partly accountable, there have been new forces at work as nicely.

On Thursday, each the European Central Financial institution and the Financial institution of England issued their very own price hikes, together with messages that additional tightening is probably going.

Lastly, the U.S. retail gross sales report confirmed spending dropped in November — not a really promising begin to the vacation season. The market reacted accordingly, and dropped 2.5% on the day.

Friday was extra of the identical. The S&P 500 fell one other 1.1% on information that S&P International’s companies PMI fell to a four-month low, whereas its manufacturing index hit a 31-month low in December.

We noticed one other notch decrease right now, with the S&P 500 (SPY) closing down 0.9%.

This has been an especially bearish interval following a traditionally bullish one. Powell retains saying there’s nonetheless an opportunity for a “delicate touchdown” the place we efficiently navigate inflation with out triggering a recession, however that’s trying much less and fewer seemingly.

Even when we do find yourself in a recession, that’s definitely not the tip of the world. Shares have at all times recovered their recession losses over time, and I don’t anticipate that to alter now.

Is the street going to be bumpy? Sure.

However these bumps don’t imply we must always panic. It simply means we’ve to be nimble. The methods that outperform going ahead gained’t essentially be the identical as what labored in the course of the bull market. However right here’s one thing unimaginable…

Making use of POWR Scores to development shares has been a constant winner by way of bear markets, bull markets, expansions, recessions, and all the things in between. Going all the way in which again to 1999, this technique has delivered optimistic returns in yearly however two and has overwhelmed the market by double-digit share factors yearly however one.

It’s like nothing I’ve ever seen. And it’s a superb sign we must always keep the course. As soon as we have weathered the storm and the clouds begin to roll out, we’ll personal a portfolio of development shares able to take off because the leaders within the subsequent bull market.

These are going to be some enjoyable occasions, y’all!

The bears are awake. However right here’s a enjoyable reality… in 2022, the market has had 9 different selloffs to rival this four-day 5% drop. And 6 of these 9 occasions, the market went on to rally about 4% to six% within the days that adopted. Possibly we’ll get that shock Santa Claus rally in spite of everything!

What To Do Subsequent?

See my high shares for right now’s market contained in the POWR Progress portfolio.

This unique portfolio will get most of its recent picks from our confirmed “Prime 10 Progress Shares” technique which has produced stellar common annual returns of +49.10%.

And sure, it continues to outperform by a large margin even throughout this tough and tumble bear market cycle.

If you want to see the present portfolio of development shares, and be alerted to our subsequent well timed trades, then think about beginning a 30 day trial by clicking the hyperlink under.

About POWR Progress e-newsletter & 30 Day Trial

All of the Finest!

Meredith Margrave

Chief Progress Strategist, StockNews

Editor, POWR Progress E-newsletter

SPY shares . Yr-to-date, SPY has declined -19.06%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Creator: Meredith Margrave

Meredith Margrave has been a famous monetary knowledgeable and market commentator for the previous 20 years. She is at the moment the Editor of the POWR Progress and POWR Shares Beneath $10 newsletters. Be taught extra about Meredith’s background, together with hyperlinks to her most up-to-date articles.

The publish Bear Market is Again Once more… appeared first on StockNews.com

[ad_2]