[ad_1]

Enterprise magnate Jack Ma, who managed greater than 50 % of the fintech big’s shares, will now maintain simply 6.2 %.

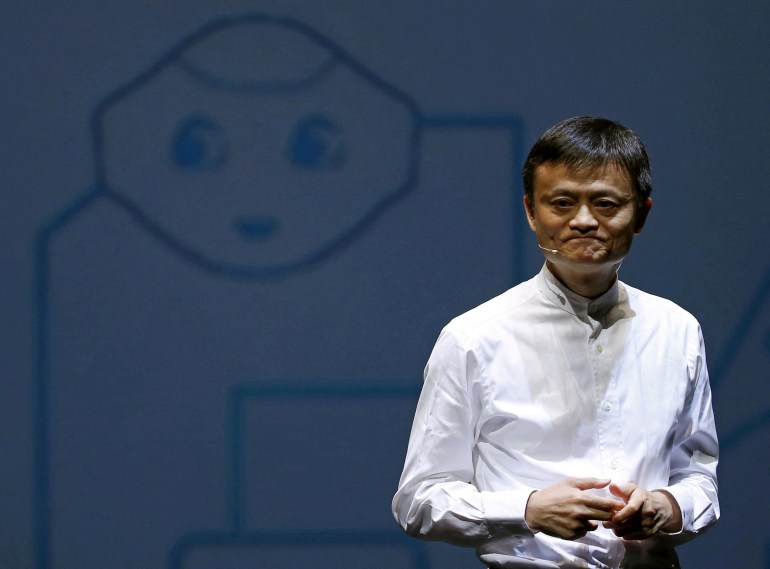

Chinese language enterprise magnate Jack Ma will cede management of fintech big Ant Group after a Communist Celebration crackdown on the nation’s tech sector that focused the billionaire.

The corporate stated in an announcement on Saturday it was adjusting its possession construction in order that “no shareholder, alone or collectively with different events, can have management over Ant Group”.

In November 2020, Ant’s $37bn preliminary public providing (IPO), which might have been the world’s largest, was cancelled on the final minute. It led to a compelled restructuring of the monetary expertise agency and hypothesis the Chinese language billionaire must cede management.

Ma not directly managed 53.46 % of Ant Group’s shares, making him the corporate’s “management particular person”. However now he’ll maintain simply 6.2 % of the voting rights following the adjustment, in keeping with the knowledge within the assertion.

“The adjustment is being carried out to additional improve the soundness of our company construction and sustainability of our long-term growth,” the Ant assertion stated.

Ten people – together with the founder, administration and workers – will “train their voting rights independently”, it stated.

Andrew Collier, a capital researcher, informed Al Jazeera that Beijing had two issues with Ma.

Collier defined that Ma is “well-funded, very talked-about billionaire who controls two massive corporations” and that he began to compete with some state-owned banks in China that are “the spine of the financial system”.

“For these two causes, they thought he was a risk and they’re chopping him down in dimension.”

Ant operates Alipay, the world’s largest digital funds platform, which boasts lots of of hundreds of thousands of month-to-month customers in China and past.

Crackdown

Ma’s ceding of management comes as Ant is nearing the completion of its two-year regulatory-driven restructuring, with Chinese language authorities poised to impose a effective of greater than $1bn on the agency, Reuters information company reported in November.

In a speech at a summit in Shanghai, the mercurial tycoon stated banks operated with a “pawnshop” mentality and accused monetary watchdogs of stifling progress.

The anticipated penalty is a part of Beijing’s sweeping crackdown on the nation’s expertise titans over the previous two years which has sliced lots of of billions of {dollars} off their values and shrunk revenues and earnings.

However Chinese language authorities have in current months softened their tone on the tech crackdown amid efforts to bolster a $17 trillion financial system that has been badly damage by the COVID-19 pandemic.

“With the Chinese language financial system in a really febrile state, the federal government is seeking to sign its dedication to progress, and the tech, personal sectors are key to that as we all know,” stated Duncan Clark, chairman of funding advisory agency BDA China.

“At the very least Ant traders can [now] have some timetable for an exit after an extended interval of uncertainty,” stated Clark, who can also be an creator of a e book on Alibaba and Ma.

Beijing has additionally hit Alibaba – the web titan co-founded by Ma that operates standard Chinese language procuring platforms Taobao and Tmall – with a file $2.75bn effective for alleged unfair practices.

Nevertheless, in an indication that the official grip might now be loosening, authorities stated final month Ant had received approval to boost 10.5 billion yuan ($1.5bn) for its shopper finance arm.

Information of the approval despatched shares in Alibaba hovering nearly 9 % in Hong Kong buying and selling, whereas different tech corporations have been additionally boosted on hopes the sector crackdown could possibly be easing.

Alibaba’s newest earnings information in November confirmed a lack of 20.6 billion yuan ($3bn) for the third quarter. The corporate didn’t launch full gross sales figures for its Singles’ Day procuring bonanza in 2022 for the primary time.

Ma has maintained a decrease profile since Ant’s failed IPO, punctuated by appearances at charity occasions and occasional sojourns abroad.

[ad_2]