[ad_1]

Many small retail companies be taught to do payroll by themselves. The issue is that it’s simple to get overwhelmed by ever-increasing piles of paperwork and lose sight of the larger image — income. Earlier than you understand it, earnings have dipped and also you’re left feeling annoyed.

Payroll-to-sales ratio is a vital a part of retaining your corporation working easily, and understanding what it means and preserve it low will remedy many issues alongside the way in which.

Right here’s our helpful run-through of all the things you might want to find out about payroll-to-sales ratios, optimize your ratio, and the highest ten payroll software program for making that occur.

What’s payroll-to-sales ratio?

Your payroll-to-sales ratio is the proportion of your income that goes to payroll prices. Right here, a low share is sweet as a result of it means your corporation is extra worthwhile. The upper your gross sales and the decrease your labor prices, the smaller your share will likely be.

What’s the optimum payroll-to-sales ratio and the way do you get there?

Optimum payroll-to-sales ratios range between industries. Based on a breakdown by Netsuite, the common payroll-to-sales ratio for retail is between 10% and 20%. So, it’s a good suggestion to make that your benchmark and keep away from exceeding 20%.

To get an optimum share, you possibly can both improve gross sales, lower payroll bills, or each. However this isn’t simple to place into observe. Extra on that later.

The way to calculate payroll-to-sales ratio

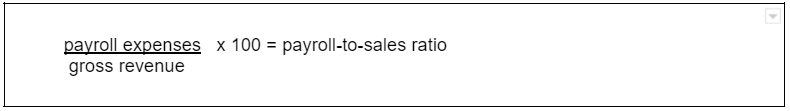

You should utilize a simple arithmetic equation to calculate your retailer’s payroll-to-sales ratio:

Say your month-to-month income is $25,000 and your payroll bills are $2750. 25,000 divided by 2750 is 0.11. Then multiply 0.11 by 100, which will get you 11%. That might be your payroll-to-sales ratio.

If the common retail payroll-to-sales ratio is 10-20%, then the retail retailer in our instance is doing very effectively.

The way to preserve your payroll-to-sales ratio low

The quickest answer to retaining payroll-to-sales ratio low is just chopping worker hours. However that’s not an incredible plan of action for those who want the workers you’ve received and wish to preserve them completely happy. What you do together with your worker hours is extra essential than chopping them down. For instance, decreasing your share to 10% received’t profit your corporation if it leaves you understaffed.

Listed here are another methods to maintain your payroll-to-sales ratio low:

Rent solely mandatory personnel

Lowering payroll bills begins with hiring. Or reasonably, not hiring. Take a look at all the things out of your variety of shifts to your busiest hours to get an correct thought of how a lot assist you actually need. This may assist reduce any cash on overstaffing.

Rigorously plan worker shifts

Cautious scheduling pays dividends. Get into the behavior of assigning shifts on this order:

- Administration

- Full-time senior staff

- Newer full-time workers

- Half-timers

By the point you get to scheduling your part-time staff, you’ll simply be plugging the gaps in your schedule. You received’t must squeeze as a lot of your full-time staff’ shifts into days which can be already adequately lined.

Additionally, share your schedule together with your group upfront. If one thing’s not working, you’ll have loads of time to handle points earlier. Which means there’s much less threat of the one obtainable particular person being on the verge of time beyond regulation.

Utilizing worker scheduling instruments may also help you do each of these items. Merely fill in your finances and worker availability, then watch because the software program robotically creates your schedule. Then, you should utilize an app like Homebase to publish the schedule and make any updates. That means staff all the time know once they’re purported to be on shift.

Keep away from time beyond regulation work

Whereas some time beyond regulation could also be unavoidable, it’s finest to scale back it as a lot as attainable. You need to pay staff time and a half once they work greater than 40 hours. This additional price can add up in time and should result in burnt out workers in the event that they’re constantly working lengthy shifts.

Should you’re questioning why time beyond regulation occurs, a number of the frequent culprits are poor time administration and lack of communication.

To scale back time beyond regulation, set alerts when an worker’s time beyond regulation is about to kick in. That means, you may make positive they go away their shift earlier than you must pay them time and a half. Should you don’t have any group members obtainable to take over their work, it is likely to be a sign that you’ve an understaffing subject.

Strategize to extend gross sales

A low payroll-to-sales ratio may additionally imply you might want to increase your gross sales. For example, there is likely to be a difficulty with bringing in foot visitors or determining your best-selling merchandise.

Should you’re hitting your quarterly targets however are nonetheless struggling, analysis attainable streams of latest income you possibly can faucet into. You can strive:

- Getting buyer insights on what they like about your retailer

- Researching new, in-demand merchandise you might deliver into your store

- Revamping your on-line retailer or web site

- Rising your social media presence

Have a contingency plan for the slower months

Work out what to do in the course of the low season, every time that is likely to be for you. For example, outlets in seaside cities are quiet in winter, however the reverse is true for outlets close to ski resorts. You can discover extra gross sales elsewhere or make use of your additional time to deal with non-urgent duties like workers coaching or reassessing your stock.

Relying on the sort of enterprise you run, you might additionally think about hiring seasonal staff and college students. Should you reside close to a university campus and have a number of younger clients, that is ideally suited. Your pupil staff will return to high school as your gross sales drop, so your ratio will keep the identical.

Revise your finances plan weekly

Issues change shortly within the retail world, which suggests retailer house owners and managers usually wrestle with sticking to a strict finances. Razor-thin revenue margins usually imply small companies can’t afford to lose cash by overspending on payroll.

A very good finest observe is to do a weekly finances overview. Should you examine your prices towards your finances repeatedly, you’ll catch errors and overspending sooner and stop an excessive amount of harm to your backside line. Homebase has a nifty labor forecasting software that offers you an outline of previous, current, and future prices.

Develop worker talent units

Lastly, put money into workers coaching. When you have multi-skilled staff, they will simply hop from one function to a different if you want them. That saves you the effort of discovering obtainable workers members when sudden rushes or duties come up.

Bonus: Staff will likely be happier if you put money into their skilled growth!

Greatest practices for managing payroll for retail

To date, we’ve lined recommendations on retaining your payroll-to-sales ratio low, however what about payroll processing itself? Right here’s what you might want to find out about managing your payroll system to deliver your payroll-to-sales ratio down and your earnings up.

Set up an optimum pay interval

Determine how usually your staff will get their paychecks. The selection is between paydays:

- As soon as a month

- Twice a month (e.g., semi-monthly)

- Each week

To determine, weigh your corporation and worker wants. You may assume that going with month-to-month paychecks is the best choice since you’ll have decrease payroll processing prices. However don’t neglect that staff usually discover it extra handy and cozy to have bimonthly and even weekly paydays.

Account for worker work hours precisely

Staff might arrive to shifts late, go away early, and take prolonged breaks. And all these pesky minutes can eat into your payroll finances and improve the danger of time beyond regulation. So, ensure you document the time truly labored, not the time scheduled.

Ask staff to make use of time playing cards once they arrive at work and go away on the finish of the day to document shifts in real-time. Software program like Homebase have a time clock function that lets staff clock out and in by way of an app and robotically syncs with payroll. It even has a geofencing function, so you understand everybody’s solely clocking in whereas truly at your premises.

Doc all the things

Federal legislation says that it’s essential to preserve paperwork for 4 years after submitting your quarterly taxes. This additionally occurs to be finest observe to comply with. Report all the things from withholding kinds to pre-hiring information.

To make sure you do all the things accurately with out dedicating each waking second to paperwork, use an HR software program compliance function. Platforms like Homebase deal with compliance be just right for you, so you possibly can relaxation simple figuring out that you just’re doing all the things above board and deal with extra high-value work like boosting gross sales.

Hold your self updated on payroll tax legal guidelines

Small issues can set off a big change in worker tax standing. It may even be one thing simple to overlook, like an worker shifting tackle or turning 50. Be taught all the things you possibly can about tax legal guidelines to keep away from doing all your payroll incorrectly and think about using compliance instruments to assist you.

Vicki Lambert, the Payroll Advisor, tells us that it may well price $300 for each tax error and a whopping $2000 for breaking wage and hour federal legislation.

Clarify your payroll system to staff

Errors occur when staff don’t perceive your payroll system. But it surely’s nonetheless your duty to get all the things proper. So be express about:

- The method you employ

- All of the codes on their paychecks

- The tax classification system

- How wage is set

- Procedures for dealing with errors

Use retail payroll software program

Fortunately, you possibly can outsource your payroll providers to a retail payroll answer like Homebase. That means, you’ll have the ability to streamline your course of by automating payroll, tax funds, and filings, and even doing direct deposits. Better of all, you save time however can relaxation simple figuring out that your payroll will likely be error-free.

10 finest retail payroll software program instruments

Now, let’s have a look at a number of the prime payroll software program available on the market as we speak and their options. It’s price noting that you could purchase some individually, whereas others are a part of a human sources software program suite.

| Software program platform | Most important options | Base worth (per thirty days) |

| Homebase | Built-in timesheets, limitless pay runs, auto tax funds and filings, direct deposits, new worker onboarding | $39 +$6 per worker |

| Zenefits | Limitless pay runs, auto tax funds and filings, direct deposits, garnishment assist | Add Payroll to the HR suite for $6 per worker |

| Justworks | Auto tax funds and submitting, automated deposits, notifications | $59 per thirty days per worker |

| Gusto | Auto tax funds and submitting, limitless pay runs, garnishment assist, new rent reporting | $40 + $6 per worker |

| BambooHR | Auto tax funds and submitting, automated reminders | Contact for an estimate |

| OnPay | Auto tax funds and submitting, worker self-service, direct deposits, garnishment assist | $40 + $6 per worker |

| ADP | Auto tax funds and submitting, direct deposits, new rent reporting | $8 |

| PayChex | Auto tax and submitting, direct deposits, garnishment assist, worker self-service | $39 + $5 per worker |

| Quickbooks | Auto tax and submitting, same-day direct deposits, new rent reporting | Add to the HR suite for $22.50 + $5 per worker |

| Patriot | Auto tax and submitting, limitless pay runs, free skilled assist | $17 per thirty days + $4 per worker |

1. Homebase

Supply: https://joinhomebase.com/payroll/

Caption: Get a whole overview of all of your fee processing with Homebase.

Good for small companies with hourly staff, Homebase’s payroll software program boasts a variety of options.

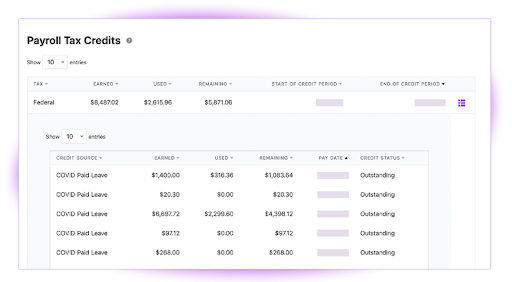

Homebase’s sensible automations spare you from information entry by robotically calculating hours, breaks, time without work, and PTO out of time clock information. In addition they pay and file taxes in your behalf and retailer all of the related info you’ll have to refer again to. Self-service options additionally permit staff to e-sign their very own payroll kinds, so that you don’t have to fret about coming into their tax particulars.

With Homebase, retailer house owners can cease occupied with payroll and change their consideration to extra urgent points like gross sales methods and worker satisfaction. We’ve additionally received a helpful free plan you will get began with.

2. Zenefits

With Zenefits’ user-friendly platform, it’s simple to make payroll submissions. Which means staff familiarize yourself with it very quickly, and clocking out and in can also be very handy with the slick performance of their cell app.

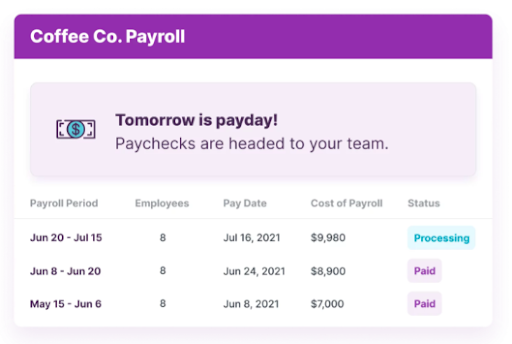

3. Justworks

Supply: https://www.justworks.com/

Caption: Justworks retains payroll administration easy and accessible.

Justworks is an all-in-one human sources platform. They provide a easy, hiccup-free payroll answer that may assist remedy a number of frequent administrative issues. Their easy interface means you possibly can entry all the things you want simply and conveniently, so that you received’t get slowed down in particulars.

4. Gusto

Gusto’s platform has all of it, together with options for payroll, worker advantages, time & attendance, hiring & onboarding, and expertise administration. There’s actually one thing for each use case. Their software program may also allure staff with its easy-to-use dashboard and pay advance function.

Most significantly, Gusto’s payroll software is tremendous user-friendly and intuitive, so you possibly can course of yours in just some clicks.

5. BambooHR

BambooHR simplifies payroll by making each a part of the payroll course of crystal clear. It permits you to preserve monitor of all of your workers information and even reminds you when staff have upcoming birthdays. And for those who need assistance with something, their enthusiastic assist group will likely be completely happy to stroll you thru it.

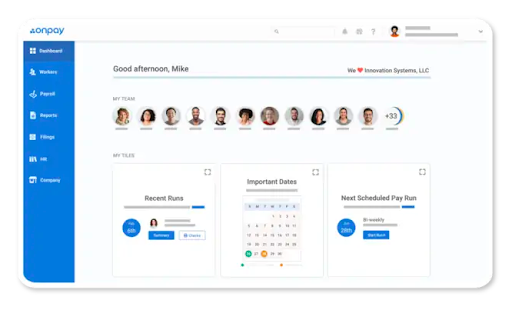

6. OnPay

With OnPay, you get a variety of HR and payroll providers which can be easy but efficient. Many customers praise the platform’s flexibility and pace in dealing with day-to-day payroll processes. They’ve additionally received specialised payroll providers for companies and organizations like eating places, farms & agriculture, nonprofits, and church buildings.

Supply: https://onpay.com/payroll/software program

Caption: OnPay has a easy, easy-to-use dashboard.

7. ADP

ADP is an HR and payroll system that’s good for companies of all sizes, whether or not you’ve received 1 or 1000 staff. They’ve a variety of options past simply payroll, together with advantages and insurance coverage, HR outsourcing, and compliance providers and are enthusiastic about offering a seamless person expertise and glorious customer support.

8. PayChex

PayChex was constructed particularly for payroll processing. It makes enterprise house owners’ lives simple with its extremely accessible platform and buyer assist options. Staff may also benefit from PayChex’s helpful self-service instruments, and you’ll run analytics on what they most frequently use the app for.

9. QuickBooks

Quickbooks is a sturdy payroll platform that helps 1000’s of small companies keep compliant with ease. In truth, if a buyer makes an error whereas utilizing their system, they take duty by serving to you to resolve it and reimbursing you as much as $25000.

Quickbooks additionally presents identical day deposits for paydays, so your staff received’t have to attend.

10. Patriot

Supply: https://www.patriotsoftware.com/payroll/

Caption: Use Patriot to begin up your small enterprise.

Made for anybody from small companies to accountants, Patriot has a easy three-step payroll course of. It’s an incredible possibility for retail companies beginning out because it’s easy and inexpensive however has all of the payroll options you want. Onboarding is particularly simple with their Setup Wizard function.

How managing your payroll-to-sales ratio can profit your retail retailer

After we’re speaking about payroll, the stakes are excessive for companies of all sizes — and particularly for small retail companies. One unhealthy transfer, and also you lose income. Or worse, incur a hefty tax superb.

However, to not worry. Should you perceive your payroll-to-sales ratio, you possibly can see whether or not you’re within the optimum vary and strategize accordingly. It’s only a matter of pushing your share down by growing gross sales and chopping pointless payroll prices.

All-in-one HR software program like Homebase can offer you an actionable payroll answer. Our platform can prevent time, spare you pointless prices, and put an finish to sleepless nights come tax season. Better of all, it’ll allow you to decrease your gross sales to payroll ratio and stop wages from consuming up your earnings.

[ad_2]