[ad_1]

Shares don’t rise eternally. Additionally they don’t fall eternally.

Whereas every little thing you learn on Twitter and see on CNBC nowadays will probably make you’re feeling like this inventory market crash won’t ever finish, you must know that in some unspecified time in the future, it’s going to. And when it does, we’re going to get a generational shopping for alternative.

One carefully watched technical indicator suggests the inventory market crash might finish fairly quickly.

This indicator has flashed twice not too long ago. It additionally flashed on the inventory market bottoms of March 2020, March 2009, and November 2002.

That’s proper. This technical indicator efficiently predicted the ending of the COVID-19, 2008 monetary disaster, and dot-com crashes. Now, it’s predicting the tip of the 2022 market crash.

If proper once more, this indicator could possibly be your “golden ticket” to market fortunes over the following 12 months.

Right here’s a deeper look.

Present Oversold Situations

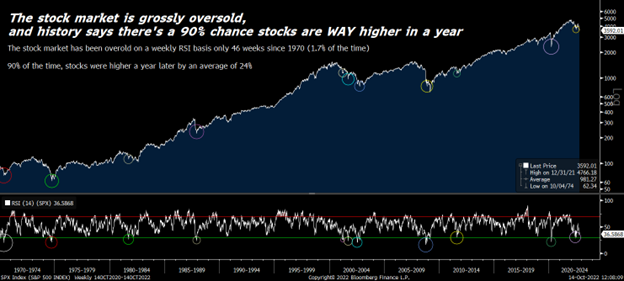

The indicator we’re speaking about is the weekly Relative Energy Index for the S&P 500.

This metric gauges the weekly shopping for strain within the inventory market. And it tells us how overbought or oversold shares are in any given week utilizing a studying from 0 to 100. Overbought circumstances are sometimes quantified by ranges over 70. Oversold circumstances are sometimes quantified by ranges lower than 30.

We’re oversold at the moment. Not at this precise second – however again on the summer time lows, the weekly RSI on the S&P 500 dropped to 30 for the primary time since March 2020.

That’s noteworthy as a result of the inventory market not often spends time as oversold. The S&P 500’s weekly RSI has been oversold throughout solely 46 weeks over the previous 50 years. Meaning the market has been oversold on a weekly foundation only one.5% of the time.

Weekly oversold circumstances out there are extremely uncommon. They’re additionally extremely bullish.

Every time the market does change into oversold on a weekly foundation, it tends to be working via a bottoming course of after a horrible crash. Certainly, 90% of the time, shares are greater 12 months later – and never by slightly. The typical achieve within the 12 months following a weekly oversold studying is about 24%!

Supply: Bloomberg. Offered by the Creator; Thanks!

The one exceptions? Late 1973 and early 2001. However again in 1973, the market was coping with 10%-plus inflation that was rising quickly. In 2001, the market was nonetheless buying and selling at a really wealthy valuation a number of of 21X ahead earnings. At this time, inflation charges are at 8% and falling, whereas the ahead earnings a number of is simply 16X – under its 5-, 10-, 20-, and 30-year averages.

In different phrases, historical past says we’re both at or very near a inventory market backside. It could be unprecedented for shares to be this oversold and undervalued and hold falling… until a so-called “black swan” danger emerges.

And we don’t foresee any of these dangers on the horizon. As such, we expect {that a} backside is shut. And so is a generational turning level.

The Ultimate Phrase

Bear markets are bizarre.

In good occasions, buyers are at all times telling themselves: “Yeah, when that subsequent inventory market crash occurs, I’m going to purchase the dip and make a lot cash.”

But, when that subsequent inventory market crash does come, that normally doesn’t occur. As a substitute, we get scared.

And I get it. Bear markets are scary. When shares are crashing, it looks as if there should be a sinister motive for it. Buyers worry the worst – as if the economic system is about to explode.

In fact, it by no means really blows up. The economic system, the markets, and shares all take a pair hits after which bounce again.

The buyers who earn a living throughout bear markets are those who understand this and don’t panic. They’re those who purchase, maintain, and look ahead to higher occasions.

Because it seems, ready is definitely essentially the most useful factor you are able to do within the inventory market, particularly throughout bear markets!

The good Charlie Munger – Warren Buffett’s right-hand man – as soon as mentioned that the large cash within the inventory market isn’t made within the shopping for or the promoting however within the ready.

So, right here’s my two cents on this market crash. Purchase high-quality development shares at big reductions at the moment… then, wait.

Sounds easy, I do know. However typically, the straightforward reply is the perfect one.

That’s actually true on this state of affairs.

When you consider so, too, I extremely urge you to click on right here.

Revealed First on InvestorPlace. Learn Right here.

Featured Picture Credit score: Photograph by Anna Nekrashevich; Pexels; Thanks!

[ad_2]