[ad_1]

Operating payroll isn’t precisely enjoyable. However each enterprise proprietor must do it in the event that they need to maintain staff glad (and paid!)

The payroll course of covers the whole lot that goes into paying staff whereas staying compliant with labor and tax legal guidelines — like registering for tax IDs, precisely monitoring hours, calculating and withholding taxes, and sharing pay stubs.

It’s so much, we get it. That’s why we’re going that will help you be taught what payroll truly is, find out how to do it proper, and what steps go into choosing the precise software program to arrange your payroll course of.

What’s payroll?

Principally, payroll is the method of paying your staff. It consists of duties like determining taxes — together with social safety and Medicare tax — and monitoring hours labored.

Changing timesheets into hours, processing tax filings and issuing 1099s, W-2s, and W-4 varieties, providing perks, and really distributing your worker’s paychecks — all of this falls underneath the umbrella of payroll.

As a small enterprise proprietor, you’re in all probability dealing with payroll by yourself. In bigger organizations, this may be delegated to an HR skilled or accountant. Fortunately, good instruments like Homebase provide the whole lot you’ll want to get the job finished proper with out hiring additional individuals.

How payroll works with small companies

Payroll works otherwise for smaller companies, primarily as a result of their wants are totally different they usually don’t want all of the bells and whistles {that a} bigger firm would possibly. These extras have a tendency to return with steep studying curves (and worth tags!)

The opposite key distinction is that many small companies select to pay their staff on an hourly foundation. And since hourly payroll is totally different from wage payroll, it requires totally different processes and instruments.

Hourly payroll relies on a price per hour and staff are paid in accordance with what number of hours they work. Salaried staff, however, receives a commission a set quantity every month. Hourly payroll requires cautious calculation of every worker’s timesheets and extra time, so time clocks and worker scheduling software program are sometimes a necessity.

The totally different components of payroll

There are numerous processes and duties that go into working payroll, and it’s not a straightforward activity to tackle: you’ll want to gather worker data, arrange a payroll schedule, calculate and deduct tax withholdings, and an entire bunch of different stuff that may rapidly really feel fairly overwhelming.

Keep in mind that you’re not by yourself, and also you don’t must DIY payroll on your total enterprise. Now, let’s break a few of these payroll components down a little bit.

Payroll schedules

For small companies with hourly staff, a payroll schedule is a mix of a pay interval, a time interval the place staff labored, and a pay date (the day your staff obtain their checks).

The commonest payroll schedules within the US are weekly, biweekly, semi-monthly, and month-to-month. Weekly schedules are finest for small companies as a result of they simplify calculating extra time funds, that are often irregular. This manner, staff additionally receives a commission as quickly as doable, which provides them extra management and suppleness over their funds.

Choosing the proper schedule for your online business is essential as a result of it impacts the whole lot from payroll processing prices to worker morale to compliance with state and federal legal guidelines.

Payroll taxes

Calculating and withholding taxes are important components of working payroll. Taxes and charges also can fluctuate by state, which may make this complete course of extra difficult.

Excellent news: there are solely 5 federal and state payroll taxes you’ll want to know to get began:

Upon getting that down, examine if your online business is topic to any extra state or native taxes.

Medical insurance contributions

Providing medical health insurance to staff is a superb profit that may set your online business aside and entice high expertise in a aggressive labor market. However if you happen to’re primarily working the present by your self, determining how medical health insurance contributions and payroll taxes work together may be daunting.

Principally, employer-sponsored medical health insurance premiums are pre-tax for each staff and employers. Which means the cash you spend on worker medical health insurance premiums may be exempt from federal taxable earnings and payroll taxes (in fact, it’s best to all the time examine along with your Licensed Public Accountant!)

So earlier than you calculate and withhold tax, ensure to take any profit contributions and deductions into consideration.

Payroll prices

There may be fairly a number of prices related to working payroll easily. However relying on the kind of payroll system you employ and whether or not you outsource these actions or not, your payroll prices can fluctuate an incredible deal. If you happen to’re utilizing a payroll service answer, you’ll have bills like:

- A base month-to-month price and charges for every worker you have got on payroll

- 401k distribution

- Monitoring worker time

- Employees’ compensation

- Direct deposit, state, and federal tax filings

- Paid depart and extra time pay

- Bonuses

Payroll abstract stories

A payroll abstract report exhibits you an outline of all of your payroll actions. This consists of worker particulars like internet and gross pay and employer taxes. Sustaining and correctly storing these paperwork is essential as you’re required by the federal authorities to submit a number of payroll report varieties, together with Kind 940, Kind 941, W-2s, and W-3s.

You may additionally be answerable for a neighborhood payroll report, so ensure to examine your native employment legal guidelines to cowl your bases.

choose the right payroll software program for your online business

You may undoubtedly course of your personal payroll manually, but it surely’s a sophisticated course of that may depart room for errors. That’s the place payroll software program is available in. These instruments make it easier to scale back labor prices, keep compliant with federal and state legal guidelines, and make fewer payroll errors.

There are various several types of payroll software program, together with options like Gusto, BambooHR, and OnPay. However most of those platforms aren’t made particularly with hourly staff and small companies in thoughts. Which means they don’t provide an all-in-one answer with instruments for scheduling, time monitoring, automated deduction calculations, and all the opposite features which can be a should for hourly payroll.

Plus, they’re typically designed for bigger corporations and aren’t geared in the direction of companies with underneath 20 staff.

So when selecting a payroll supplier, ensure it’s not solely safe and scalable however truly made for a enterprise like yours!

arrange and course of your payroll

Relating to truly establishing your payroll system, there are a number of essential issues to bear in mind. Earlier than you get into the nitty-gritty of it, resolve what your payroll insurance policies might be and the way you’ll deal with the method.

Will you be dealing with the whole lot in-house? Or would you favor to outsource it to an accountant or on-line payroll service? And what’s your payroll schedule going to appear like? Don’t neglect to doc your insurance policies so the whole lot is publicly accessible and may be communicated to your staff transparently.

Then, register as a enterprise with the IRS and get your employer identification quantity (EIN). Ensure each member of your staff completes the proper tax varieties, after which calculate what number of federal and state taxes you’ll want to withhold from every of your worker’s earnings.

As an employer, you should additionally submit your federal tax return every quarter. Then, on the finish of yearly, you’ll have to arrange your annual filings, together with your W-2s for each workers member.

Lastly, calculate your salaries and pay your staff. All that will sound like so much, however the course of may be summarized into these ten steps:

- Get your worker’s EIN

- Register with the Digital Federal Tax Fee System (EFTPS)

- Study your space’s payroll legal guidelines

- Decide your payroll schedule

- Report new staff to the state

- Put together the right paperwork like W-4s

- Work out new rent pay charges

- Calculate tax deductions and state taxes

- Disperse paychecks and keep data

- Use accounting software program to assist alongside the best way

That’s proper — it may be tough to run small enterprise payroll your self. But when that’s the trail you need to take, it’s undoubtedly doable with some endurance and energy!

How Homebase streamlines payroll for hourly staff

There are various steps concerned in finishing up the payroll course of by yourself, and they are often tough and exhausting to perform, particularly if you happen to don’t use any HR companies to help you.

Payroll software program particularly designed for small companies may help an incredible deal. It saves you the headache of getting to recollect each single payroll step your self and working the danger of falling out of compliance, even by chance. That’s why we’ve highlighted how Homebase can simplify your payroll and make it easier to keep compliant with ease.

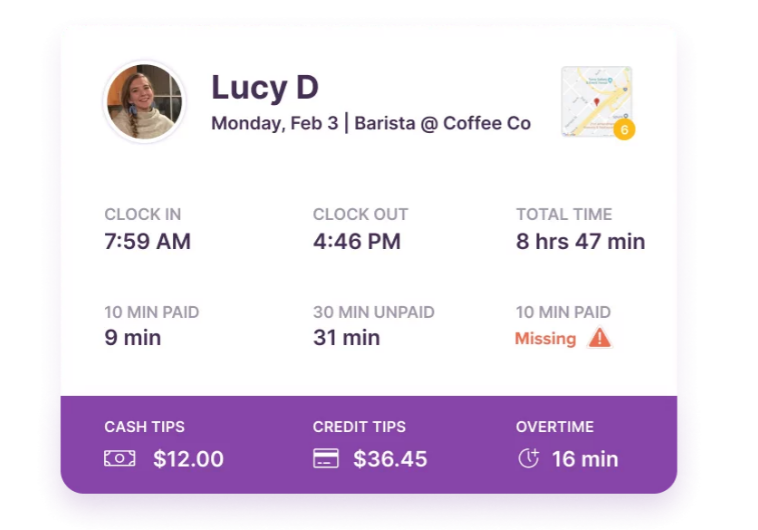

Time clocks

This characteristic allows you to flip virtually any gadget with an web connection into an worker time clock system. All you’ll want to do is obtain the net time clock for workers and sign up. Then, staff members can clock out and in with the time clock through the use of their customized pins.

After that, you’ll be capable to observe hours, breaks, extra time, and paid time without work. Homebase will immediately convert your timesheets into hours and wages in payroll. Timesheets and payroll, multi functional place!

Scheduling

Homebase’s scheduling answer helps you optimize worker schedules and makes certain you and your staff are all the time on the identical web page.

Immediately share your schedule along with your staff, use templates or auto-scheduling to optimize shifts, mechanically remind staff of upcoming shifts by way of textual content, and get alerts to keep away from extra time hours.

An optimized schedule additionally makes it simpler to trace an worker’s whole hours and learn how a lot extra time it’s a must to account for, which interprets into simpler payroll calculations on the finish of your pay schedule.

Integrations

Homebase gives varied integrations, so that you don’t have to fret about coming into and transferring information manually if you happen to’re already utilizing payroll options like Quickbooks or Sq..

From Shopify and Paychex to Vend and Toast, we ensure your complete tech stack is mechanically in sync, saving you time and chopping out pointless additional information entry.

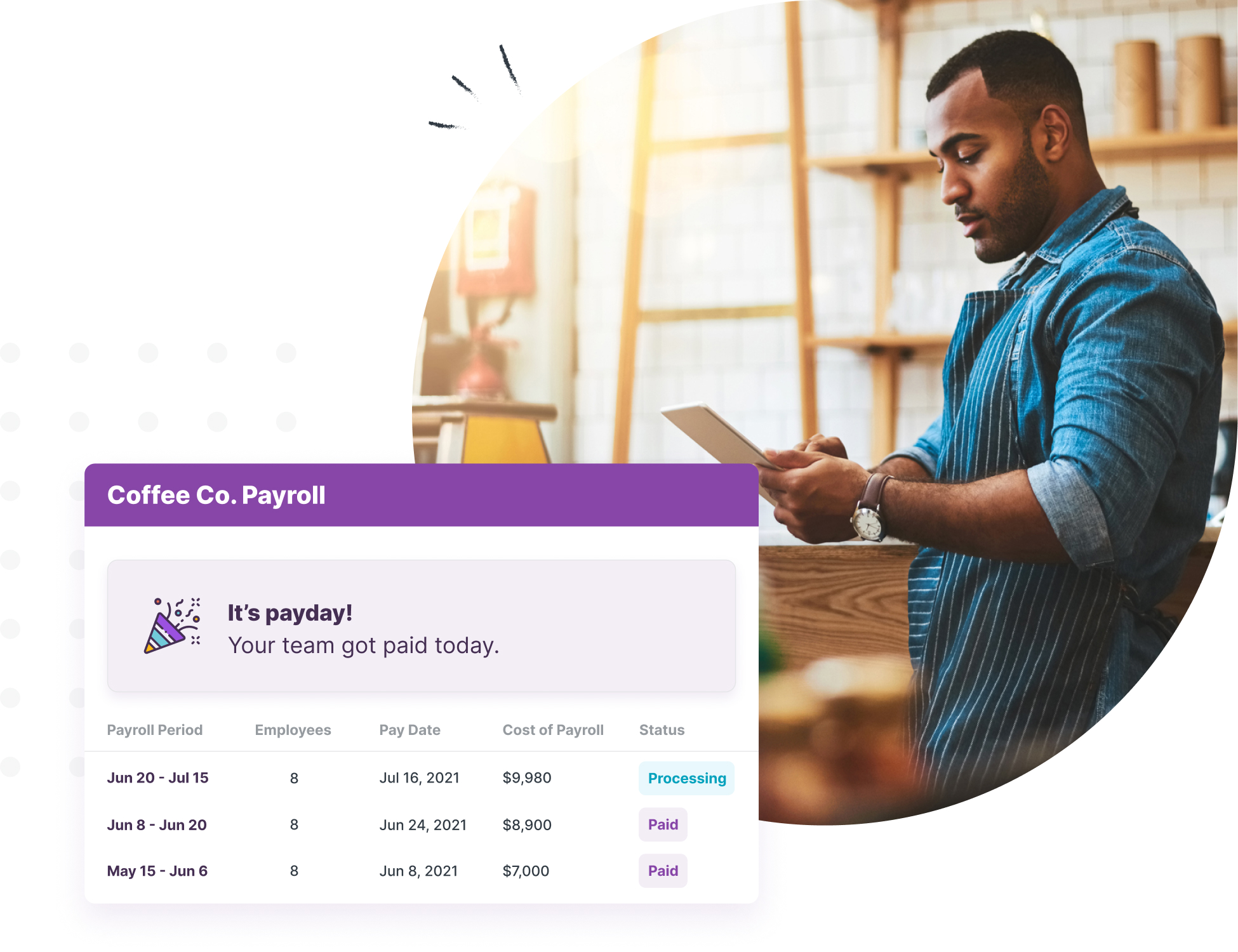

Payroll

Final however undoubtedly not least, our payroll answer automates the entire payroll course of so you possibly can give attention to the essential stuff. Right here’s what we do:

- Calculate wages and taxes and ship out right funds to staff, the state, and the IRS.

- Mechanically course of your tax filings and concern 1099s and W-2s.

- Retailer your time card data that will help you keep compliant with FLSA record-keeping guidelines.

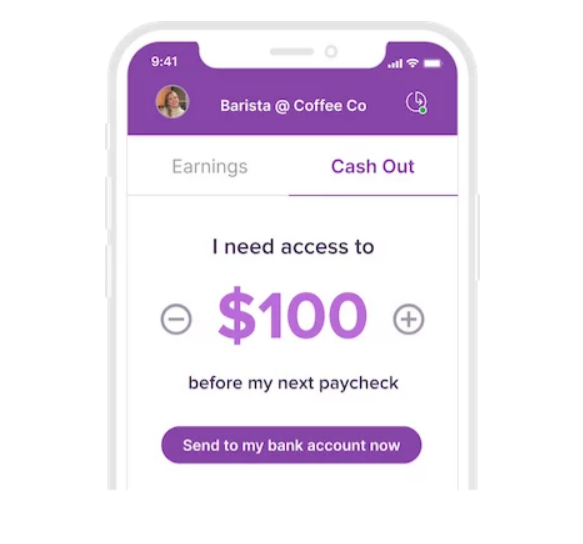

As an added perk on your staff, they’ll have the choice to entry a portion of their wages earlier than payday. This provides staff extra management when surprising bills hit, and comes at zero price or trouble for you.

Seamless payroll is only a click on away

Operating payroll as a small enterprise proprietor is difficult as a result of it includes a lot extra than simply determining wages and transferring funds.

You could calculate and withhold taxes, keep compliant with federal, state, and native legal guidelines, put together payroll stories, and resolve on a constant payroll schedule. And it’s a must to do all that whereas truly working your online business.

If that sounds too time-consuming and complicated, we’ve acquired you lined! Homebase automates your payroll course of and takes care of the whole lot from changing your timesheets into hours and wages to mechanically processing your tax filings. You simply give attention to rising your online business and doing what you like!

[ad_2]