[ad_1]

Bulls needed to sluggish their roll on Tuesday because the speedy +3.5% rally was shaved by 80% into the shut. Why did the rally use up? And what does it imply subsequent for the inventory market (SPY) going ahead? 40 yr veteran Steve Reitmeister shares his well timed market outlook, buying and selling plan and eight high picks to generate beneficial properties within the weeks forward.

shutterstock.com – StockNews

It felt like each dealer on earth hit the purchase button at 8:30am ET Tuesday morning because the softer than anticipated CPI report got here out. This led to a surprising +3.5% surge in inventory futures. If that held up it could have put the S&P 500 all the best way up at 4,130.

However that didn’t maintain up…neither did the latest excessive of 4,100…neither did the 200 day transferring common at 4033…as a substitute shares solely closed up modestly larger at 4,019.

Why did the rally use up? And what does it imply subsequent for the bull/bear battle going ahead?

That would be the focus of this week’s Reitmeister Complete Return commentary.

Market Commentary

First, and foremost a reminder to look at my “2023 Inventory Market Outlook” in case you have not already. That’s as a result of it covers the next important matters:

- Why 2023 is a “Jekyll & Hyde” yr for shares

- 5 Warnings Indicators the Bear Returns in Early 2023

- 8 Trades to Revenue on the Method Down

- Plan to Backside Fish @ Market Backside

- 2 Trades with 100%+ Upside Potential as New Bull Emerges

- And A lot Extra!

Watch Now: “2023 Inventory Market Outlook” >

The above outlook offers an vital backdrop wherein to debate all new info together with the CPI report from Tuesday morning. Assuming you will have watched it already…then let’s decide up the story from there.

Sure, the Shopper Worth Index (CPI) got here in softer than anticipated this morning (7.1% yearly improve vs. 7.3% anticipated). And sure, this softer than anticipated pattern is going on increasingly more usually.

Now the wakeup name.

7.1% is just not the identical as 2% goal (for these with who did poorly in math class).

Additionally the Producer Worth Index final week was larger than anticipated. And that’s the main indicator of the place CPI will likely be sooner or later. That’s as a result of these are the enter costs for manufactures and repair suppliers which exhibits up of their choices down the highway. That means this softer than anticipated learn could give option to larger readings sooner or later given the foreshadowing in PPI.

On high of that lots of the types of “sticky” inflation stay, properly…STICKY.

Issues like wages and rents are nonetheless too scorching. The previous difficulty of excessive wage inflation was on show within the 2X larger than anticipated month-to-month improve for wages discovered within the Authorities Employment Scenario report again on 12/5…and helped spark a 4% selloff the next week.

Consider it this fashion…CPI seems to be backwards and PPI seems to be ahead. So which is extra vital? (he asks rhetorically).

Sure, PPI. And that’s telling you fairly clearly that drawback of excessive inflation is much from solved.

I sense that because the early morning pleasure wore off, and buyers sobered up, they started to understand that it was a bit too early to rejoice the dying of inflation. And maybe they should wait to see what the Fed says Wednesday afternoon.

That’s as a result of inflation is sort of a horror film monster. You’ll be able to’t simply shoot it as soon as and assume it’s lifeless. It is going to preserve getting up every time you suppose the job is completed and the dying defying chase resumes.

The truth is, Powell has mentioned this many occasions over that the worst factor they will do is take their foot of the brakes too quickly and inflation comes again with a vengeance. Inflation must be “lifeless and buried” earlier than the Fed reverses course with decrease charges.

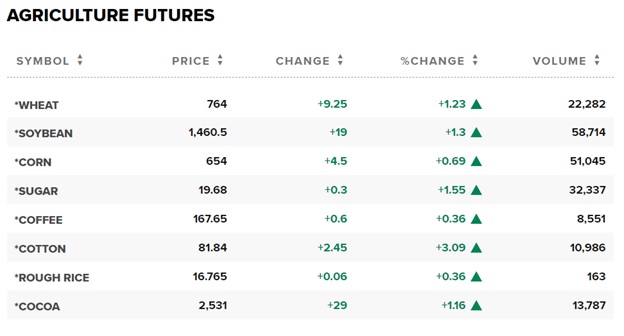

As nice proof of that discover how each time that we now have one among these large inventory rallies on information of softening inflation that commodity costs soar…which sure, speaks to inflation rising as soon as once more. The precise drawback we try to unravel.

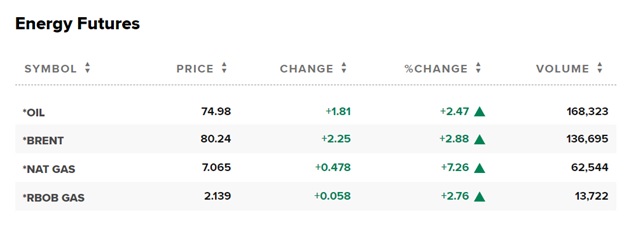

Right here was the early morning learn for power and key commodities as inventory futures soared:

Lengthy story quick, the Fed has splashed chilly water on exuberant merchants a number of occasions this yr. Thus, it pays to see what occurs with the speed hike and announcement on Wednesday afternoon.

50 foundation factors is the expectation. The actual key’s the “dot plot” of the place charges probably go sooner or later (how excessive…for a way lengthy) together with any statements they make that foreshadows future plans.

There we are going to discover out if the Fed agrees with merchants that inflation is moderating properly and they don’t have to be as hawkish for so long as beforehand anticipated. Alternatively, they could state fairly clearly that they proceed to see inflation as being extra sticky and chronic than they want, protecting them on the job for much longer…with extra ache to the financial system…and sure decrease inventory costs.

The reply to that tells you whether or not shares are really prepared to interrupt out above the all vital 200 day transferring common (4,033). Or if it’s time to head decrease as soon as once more?

Nonetheless, we’re getting foolishly sucked into the investing worlds myopic fixation on inflation and the Fed. There’s rather more happening…just like the well being of the general financial system that’s transferring nearer and nearer nonetheless to recession. That was the central theme of my 2023 Inventory Market Outlook presentation from final week with a number of main indicators pointing in that darkening path.

A main instance of this recessionary concern was on full show Tuesday morning from one other low studying for the NFIB Small Enterprise Outlook. Right here is the important thing assertion from their report:

“…many of the readings had been nonetheless per a recession and weak financial exercise.”

In order the recessionary storm clouds preserve circling…and inflation is much from lifeless…with the Fed nonetheless to maintain their foot firmly on the brakes with larger charges on the best way …then I see no knowledge in chasing this rally as shares happening over the subsequent 3-6 months makes much more sense then new bull market rising now.

The one factor at this second to alter my thoughts is a transparent Fed pivot on Wednesday to say certainly inflation is coming underneath management and they don’t should be as Hawkish as beforehand marketed.

That is doable…however extremely inconceivable given the slew of statements which have made within the latest previous. And that we now have already seen the information they’re which incorporates too scorching readings for PPI and wage inflation. And the character they’re sluggish and deliberate. Added altogether and it could be the shock of shocks for them to say “Mission Achieved” on Wednesday.

Worst case situation is one other 2-3% upside into yr finish due to present momentum plus bullish bias of Santa Claus rally.

Alternatively, if nonetheless a bear market…which is the bottom case…then retreating to the earlier lows of three,491 within the New Years remains to be within the playing cards. And certain a lot decrease.

What To Do Subsequent?

Watch my model new presentation: “2023 Inventory Market Outlook” protecting:

- Why 2023 is a “Jekyll & Hyde” yr for shares

- 5 Warnings Indicators the Bear Returns in Early 2023

- 8 Trades to Revenue on the Method Down

- Plan to Backside Fish @ Market Backside

- 2 Trades with 100%+ Upside Potential as New Bull Emerges

- And A lot Extra!

Watch Now: “2023 Inventory Market Outlook” >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, Inventory Information Community and Editor, Reitmeister Complete Return

SPY shares fell $0.22 (-0.05%) in after-hours buying and selling Tuesday. Yr-to-date, SPY has declined -14.39%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Creator: Steve Reitmeister

Steve is healthier recognized to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Complete Return portfolio. Be taught extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The put up Why Did the Tuesday Rally Shrink So A lot…So Quick? appeared first on StockNews.com

[ad_2]